In today’s fast-paced digital landscape, customers expect instant gratification and seamless experiences. Real-time payments have emerged as a game-changer in the world of online transactions, offering instant processing, auto reconciliation and confirmation.

But when is the right time to add real-time payments to your checkout process? In this post, we’ll explore the signs that indicate it’s time to make the switch, backed by compelling statistics.

The landscape of Real-Time Payments today

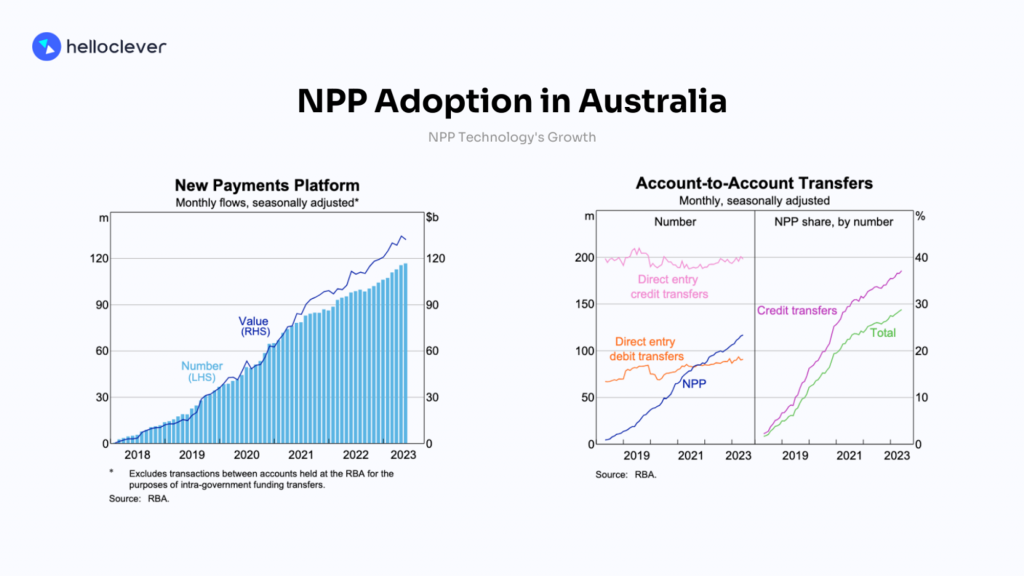

Use of Australia’s fast account-to-account payments system, the NPP, has continued to grow since its launch in 2018. The NPP enables consumers, businesses and government agencies to make real-time, data-rich payments 24 hours a day, every day of the year.

In 2022/23 the NPP processed over 1.3 billion transactions, worth more than $1.5 trillion, and usage continues to grow. Source: RBA

Signs it’s Time to Add Real-Time Payments

Adding real-time payments to your checkout process can be beneficial when you’re looking to offer customers more payment options, streamline the payment process, and reduce transaction fees significantly.

1. Customer Demand

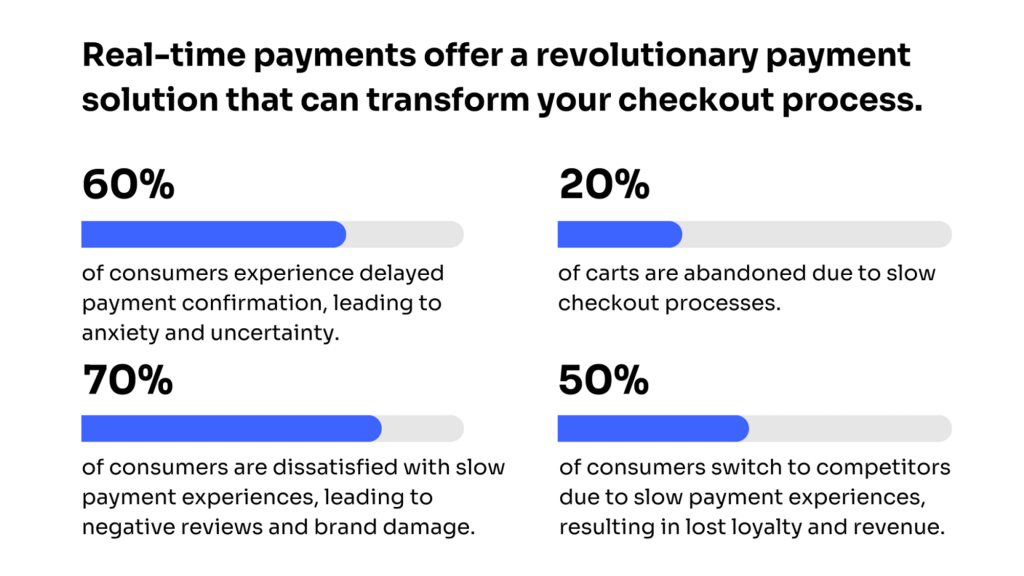

One of the most significant indicators that it’s time to add real-time payments to your checkout is customer demand. Consumers today expect instant gratification, and offering real-time payment options can help meet their expectations and improve overall satisfaction.

2. Increased Cart Abandonment Rates

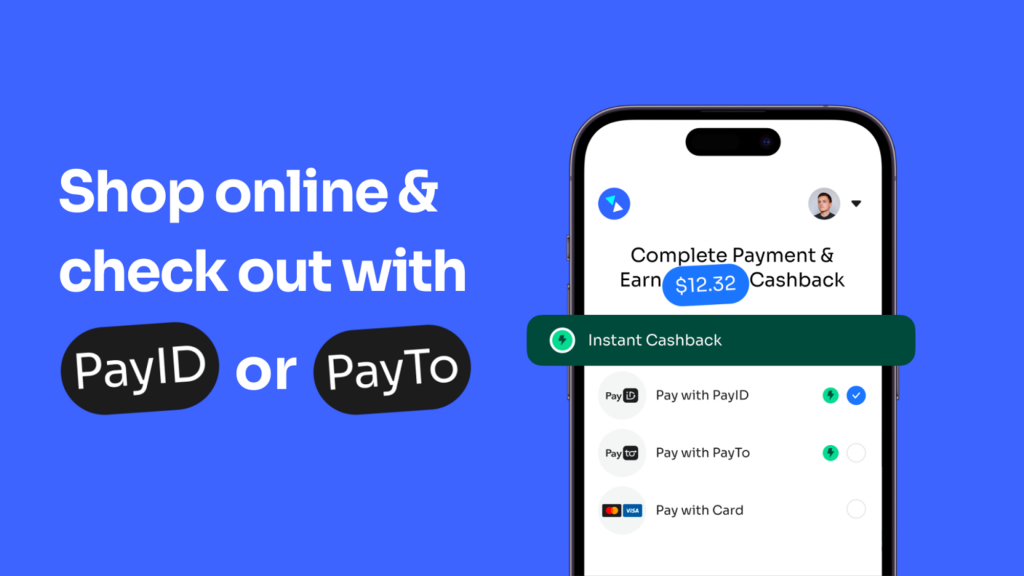

High cart abandonment rates can be a red flag indicating friction in the checkout process. If you notice a significant number of customers abandoning their carts before completing the purchase, it could be due to cumbersome payment methods that take too long to process. Real-time payments streamline the checkout process, reducing the time it takes for transactions to be completed. By offering faster payment options and instant cashback, you can lower cart abandonment rates and increase conversion rates.

Hello Clever is also the only Australian payment method with a built-in Instant Cashback loyalty program. This results in increased customer acquisition and retention rates at a lower cost than other marketing methods. Hello Clever Merchants form part of the Marketplace in the Hello Clever App where they are promoted based on consumer interests and shopping preferences.

3. Improved Cash Flow

Real-time payments offer immediate access to funds, providing businesses with improved cash flow management. Unlike traditional payment methods that involve delays in processing and settlement, real-time payments ensure that funds are available in your account almost instantly. This can be particularly beneficial for small businesses or those operating on tight budgets, as it enables better financial planning and liquidity management.

Benefits of Real-Time Payments

In an increasingly digital world, the ability to seamlessly integrate payment solutions with existing platforms is essential. Real-time payment systems can be easily integrated with major e-commerce platforms, accounting softwares, invoicing platforms, and other business tools, streamlining workflows and enhancing operational efficiency. This seamless integration enables businesses to leverage the full potential of real-time payments without disrupting their existing processes.

- Instant payment processing and confirmation

- Reduced cart abandonment rates (average decrease of 15%)

- Enhanced customer experience and satisfaction (85% customer satisfaction rate)

- Increased security and reduced fraud risk (80% reduction)

- Improved cash flow and reduced payment delays (average reduction of 3 days)

- Ability to offer instant refunds and exchanges

- Competitive advantage in the market (40% of businesses have adopted)

Real-time payments offer a revolutionary payment solution that can transform your checkout process. With signs indicating slow payment processing, high cart abandonment rates, and increased demand for instant confirmation, it’s clear that adding real-time payments to your checkout is a wise decision. Don’t wait – make the switch to real-time payments and stay ahead of the competition in the ever-evolving payments landscape.

![[HelloClever]BlogCover-FeatureUpdate-01 1](https://woo.cleverpay.store/wp-content/uploads/2024/09/HelloCleverBlogCover-FeatureUpdate-01-1-540x350.png)