In today’s fast-paced digital landscape, consumers expect instant gratification in all aspects of their lives, including loyalty programs. Gone are the days of waiting weeks or months for rewards to accumulate or be redeemed. With the advent of real-time payments, consumers are demanding instant loyalty, and businesses must adapt to meet this new expectation.

The Shift to Instant Cashback

Traditional loyalty programs often rely on delayed rewards, such as points or discounts, that take time to accumulate and redeem. However, with the rise of real-time payments, consumers can now receive instant rewards, cashback, or discounts, changing the loyalty landscape forever.

Younger consumers, particularly Millennials and Gen Z, favour straightforward and immediate benefits. Cashback rewards programs offer a clear and tangible return, which is easier to understand and feels more immediate than accumulating points for future redemption. This simplicity and directness aligns with the preferences of a demographic that values quick and clear rewards.

Benefits of Instant Cashback

Customer Acquisition and Retention: Businesses that offer cashback rewards often see better customer acquisition and retention rates. This can be attributed to the straightforward nature of cashback programs which are often more attractive to new customers and can lead to higher levels of customer satisfaction and loyalty. The direct benefit of receiving cash back on purchases can also lead to increased spending, as consumers feel they are saving money even as they spend.

Economic Considerations: In times of economic uncertainty and cost of living pressures, consumers tend to value cash returns more highly than potentially fluctuating points values. Cashback provides a form of savings on every purchase, which is particularly appealing in a tighter economic environment.

Competitive Advantage: From a business perspective, transitioning to cashback rewards programs can offer a competitive edge over businesses that still use traditional points-based systems. The immediate gratification of cashback rewards can be a strong incentive for customers to choose one brand over another.

Research and Industry Trends:

A recent study found that cashback rewards are increasingly preferred because they offer direct financial benefits and are easier to understand compared to the complexities of points systems. This study found that 60% of respondents plan to increase their reliance on rewards programs, particularly cashback options, over the next 12 months. This preference is especially pronounced among younger consumers, such as Gen Z and Millennials, who appreciate the straightforward nature and immediate utility of cashback rewards.

This study found that when making a purchase associated with a cashback rewards program, consumers can immediately see that money going straight into their pocket. That’s the opposite psychological effect to other traditional programs such as points or miles, which require a significant amount of time before the benefits can be reaped — delaying the consumer gratification.

Cashback is also generally easier to manage, understand, and earn from the consumer’s point of view compared to other programs — you spend money, you make money. In fact, 54% of loyalty program memberships are inactive. The number one reason being that it takes too long to earn points or miles for rewards.

A significant portion of loyalty program members do not actively use their memberships. For instance, research indicates that 72% of consumers use 50% or less of their loyalty program memberships, and 31% use only 25% of their memberships. These statistics suggest a gap in engagement, where consumers are enrolled in multiple programs but only actively participate in a few.

About 91% of consumers feel that many loyalty programs are similar and not well differentiated from one another. Additionally, 42% of consumers report that signing up for loyalty programs requires too much effort or that the rewards aren’t sufficiently appealing to justify the time and personal information required.

A recent Kantar study showed that when it comes to reward redemption, cashback is the most popular choice for all. Younger generations, however, are more likely to favour cashback, with Gen-Z (40%) and Millennials (41%) surpassing Gen-X (34%) and Boomers (26%). Rather than accumulating points or focusing on discounts, Gen-Z and Millennials are more likely to prioritise tangible, immediate benefits that contribute to their overall financial well-being.

The Hello Clever Approach:

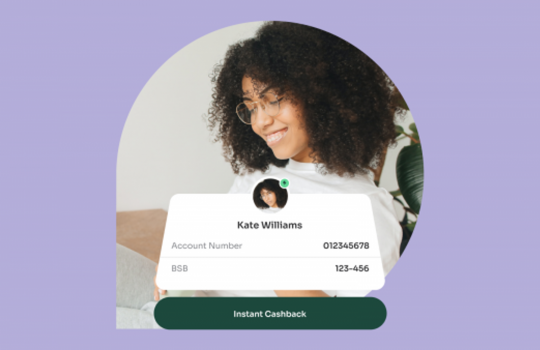

Hello Clever takes cashback rewards to the next level. Millennials and Gen Z consumers demand instant access to everything – information, people, products and now also loyalty rewards.

In an Australian first, Hello Clever users receive their reward instantly and can spend that reward immediately at participating outlets and venues. Users can even withdraw cashback rewards and receive the cash in their bank account within seconds.

In addition, every Hello Clever user receives $5 free cashback when they sign up and can earn additional free cashback for completing Missions. Examples of Missions include registering a credit or debit card for in-store cashback or referring a friend.

The synergy between real-time payments and consumer loyalty is set to grow. As technology advances, we can expect even faster transaction speeds, more personalised reward systems, and greater integration with emerging digital platforms. Businesses that embrace these innovations will be better positioned to meet evolving consumer expectations and foster deeper, more lasting relationships with their customers.