The world of payments is constantly evolving, driven by advancements in technology, changing consumer behaviour, and global economic shifts. As we step into 2024, several trends are poised to shape the landscape of payments. From the rise of Artificial Intelligent to contactless payments, here are five payment trends to watch in 2024 from our team at Hello Clever.

Artificial Intelligence (AI) in Payment Security:

As cyber threats become more sophisticated, the role of Artificial Intelligence in payment security is evolving. In 2024, AI will play a crucial role in fraud detection, risk management, and authentication processes. Machine learning algorithms will continue to analyse vast datasets in real-time, identifying patterns and anomalies to enhance the security of online transactions. The integration of AI-driven solutions will contribute to a safer and more secure payment environment.

Real-time fraud detection is a critical component of modern security measures in various industries, particularly in our sector where we deliver real-time payment transactions for our merchants.

We’ve been partnering with Flagright to reinforce our unwavering commitment to delivering the most secure real-time payment solution for our merchant partners. Real-time fraud detection is a pivotal step in minimising the risk of fraudulent activities.

👉🏻 Read more about our partnerships here.

Contactless Payment Adoption:

The trend towards contactless payments, accelerated by the COVID-19 pandemic, is set to continue its upward trajectory in 2024. Consumers increasingly value the convenience and hygiene of contactless transactions.

Merchants recognise the changing payment landscape and are adapting to consumer preferences. Businesses, ranging from small retailers to major enterprises, are investing in contactless payment infrastructure to meet the demands of their customers. This acceptance is crucial in driving the overall adoption of contactless payments.

Contactless payment infrastructure is expanding globally. Major cities and countries are investing in upgrading their payment systems to support contactless transactions. This global expansion facilitates a seamless experience for consumers, especially those who travel frequently.

Central Bank Digital Currencies (CBDCs) Integration:

Central Bank Digital Currencies (CBDCs) are becoming a global focus, with several countries exploring or implementing their own digital currencies. In 2024, the integration of CBDCs into mainstream financial systems is expected to accelerate. These government-backed digital currencies aim to streamline cross-border transactions, enhance financial inclusion, and provide a secure alternative to traditional fiat currencies. Keep an eye on how CBDCs shape the future of monetary transactions on a global scale.

Embedded payments and social commerce:

As consumers spend more time within apps and social media platforms, the trend of embedded payments in-app purchases is gaining momentum. Social commerce platforms are enabling users to make seamless purchases without leaving their favourite apps. Whether it’s buying products directly from an Instagram post or completing transactions within a gaming app, the ability to make payments without switching platforms is a growing trend.

More loyalty and rewards at checkout:

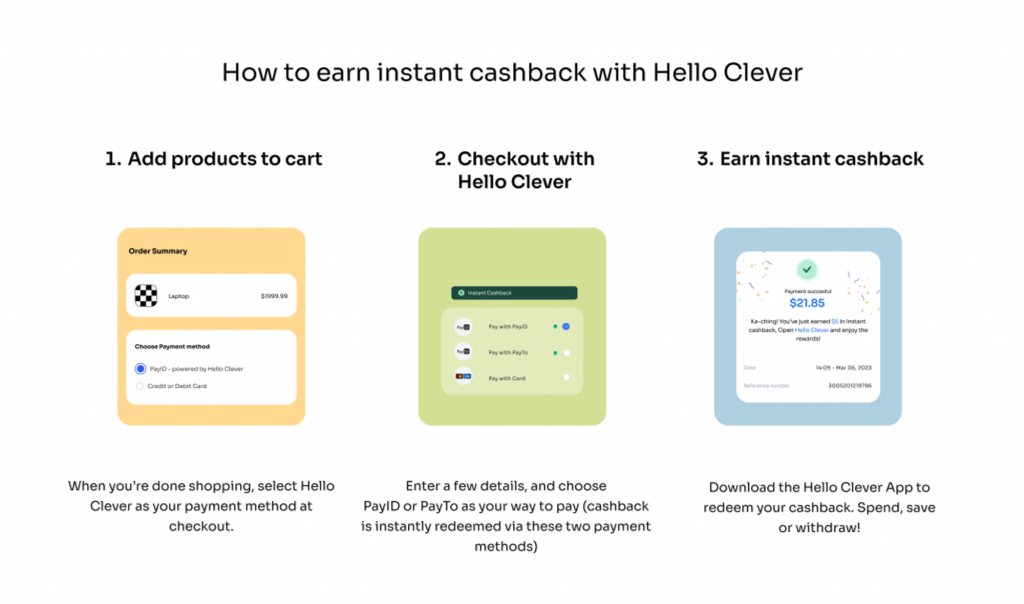

As businesses strive to enhance customer satisfaction and foster loyalty, integrating more loyalty and rewards programs at the checkout stage has become a game-changing strategy.

Loyalty programs and rewards are part and parcel to shoppers for some major brands, like Starbucks Rewards or Sephora’s Insider program. But smaller retailers are getting into the trend, too, as a way to encourage future purchases. And the best way to integrate the program often comes down to an app at checkout.

In a competitive e-commerce landscape, differentiation is key. Businesses that offer more loyalty and rewards at checkout gain a competitive edge by providing an enhanced customer experience. This added value not only sets the brand apart but also contributes to long-term customer loyalty in a market flooded with choices.

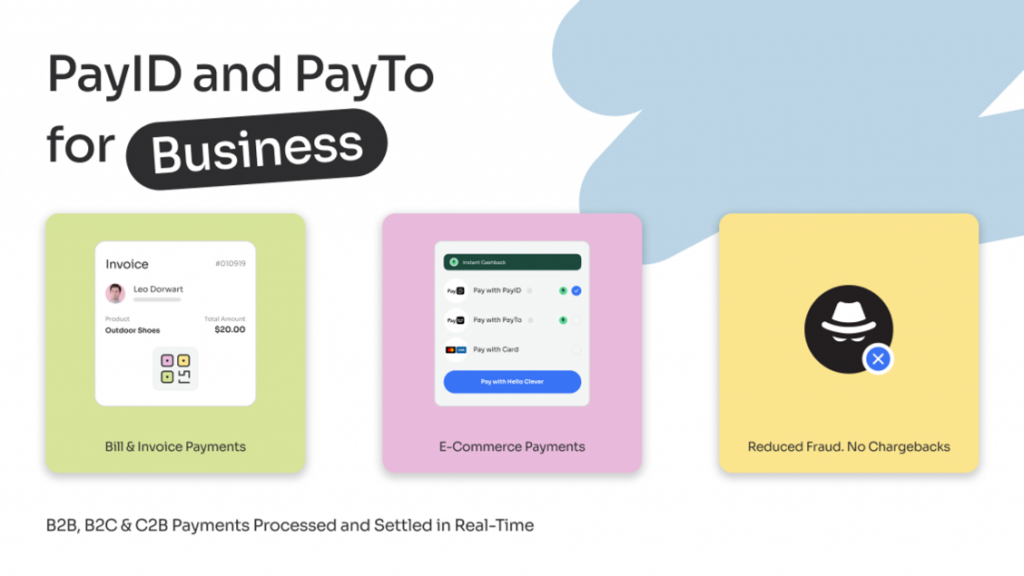

As the leader in A2A payment options, Hello Clever offers merchants with full suite of payment methods that encourage contactless payment adoption. Financial institutions and businesses often run promotional campaigns and offer incentives. Discounts, cashback rewards, or loyalty points for contactless transactions incentivise consumers to choose this payment method over traditional alternatives

🌈 Explore Hello Clever’s RTP Gateway and Instant Cashback Product here.

![[HelloClever]BlogCover-FeatureUpdate-01 1](https://woo.cleverpay.store/wp-content/uploads/2024/09/HelloCleverBlogCover-FeatureUpdate-01-1-540x350.png)